Briefly explained: what is the msci europe index???

The MSCI Europe Index is a key benchmark index for European equities, published by MSCI Inc. Calculated and published. It measures the performance of large and medium-sized companies in 15 European countries, making it an important indicator of the performance of the European stock market.

Although the MSCI Europe Index is often considered a sort of "average performance" of the European stock market, it is actually a very specific index, as it focuses on large and medium-sized companies. This means that it does not necessarily reflect the performance of smaller companies or specific sectors.

The MSCI Europe Index is used by many investors and fund managers as a benchmark index to measure and evaluate their performance against the broader European market. In this article we will take a closer look at the MSCI Europe Index and explain its significance for the European stock market.

Introduction

The MSCI Europe Index is an important tool for measuring the performance of European equity markets. Essentially, it is a stock index that includes a group of companies from different European countries. As such, the MSCI Europe Index offers investors a way to invest in a diversified portfolio that encompasses the entire European market.

The index consists of more than 400 companies from 15 countries, including France, Germany, Italy and Switzerland. The weighting of each company depends on its market capitalization. This means that a company with a higher market capitalization has a greater impact on the index than a company with a lower market capitalization.

The MSCI Europe Index is an important indicator of the performance of European equity markets. It helps investors measure the performance of their portfolios in relation to the broader market. Investors can also use the MSCI Europe Index as a benchmark to determine how well a particular fund or portfolio is performing relative to the broader European market.

- Benefits of the MSCI Europe Index:

- Broad exposure to European equity markets.

- Portfolio diversification.

- Measures the performance of the portfolio relative to the broader market.

- Use as a benchmark.

Composition of the MSCI Europe Index

The MSCI Europe Index is an equity index that tracks the performance of companies in Europe. Comprises approximately 440 companies from 15 countries, including Germany, France, the United Kingdom and Spain. Companies are weighted by market capitalization, with larger companies having a higher proportion in the index.

The composition of the MSCI Europe Index includes companies from a variety of industries, including financial services, technology, healthcare and energy. Due to the broad diversification, investors are able to diversify their portfolio to European companies and thereby reduce risk.

Some of the largest companies in the MSCI Europe Index are Nestle, Roche, SAP, HSBC and Royal Dutch Shell. These companies have a significant impact on the performance of the index due to their size and market power. It is therefore recommended to diversify your portfolios according to the shares of the companies in the index in order to minimize risk.

- Advantages of the MSCI Europe Index:

- – Broad diversification

- – Map the performance of companies from Europe

- – Larger companies are more heavily weighted and therefore have a greater influence on the performance of the index.

Especially for investors who want to invest in Europe, the MSCI Europe Index is an attractive investment instrument due to its diversification and the lower risk compared to investing in individual companies. It also allows investors to participate in the performance of large European companies.

Importance of the MSCI Europe Index

The MSCI Europe Index is one of the most important stock indices in Europe and includes the largest companies in 15 European countries. The importance of the index lies in the fact that it is considered a benchmark for the performance of the European stock market and is therefore an important indicator for investors.

By weighting companies by market capitalization, the MSCI Europe Index reflects the relative size of companies and thus provides a realistic picture of the European economy. The index allows investors to invest in a wide range of companies and thus diversify their portfolio.

The MSCI Europe Index is used by many funds and ETFs as a benchmark to compare the performance of their investments. Therefore, it is important for investors to understand the meaning of the index and keep an eye on its performance.

- The MSCI Europe Index includes 15 European countries.

- The index serves as a benchmark for the performance of the European stock market.

- The weighting of the companies is based on market capitalization.

- The index is an important indicator for investors.

- It is used as a benchmark by many funds and ETFs.

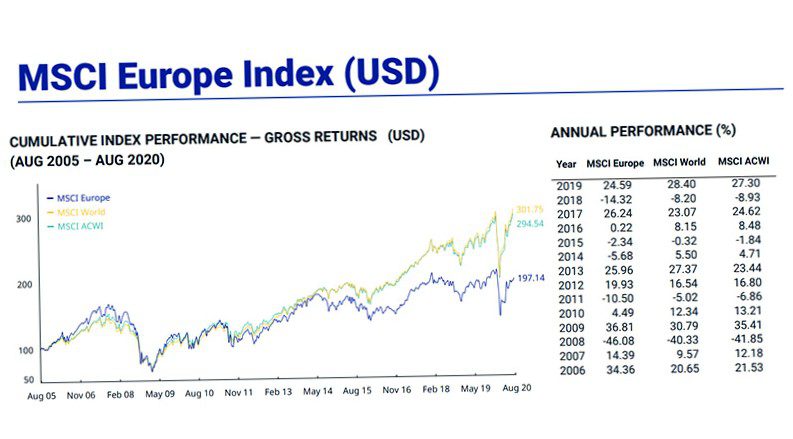

Performance of the MSCI Europe Index

The MSCI Europe Index is a stock index that measures the performance of companies in 15 European countries. The performance of the MSCI Europe Index is an important indicator for the development of the European stock market and is often used as a benchmark for fund managers.

An important factor influencing the performance of the MSCI Europe Index is the economic situation in Europe. If the economy in Europe is stagnant or declining, it will have a negative impact on the performance of the index. On the other hand, positive economic developments can lead to an increase in performance.

Another factor that can influence the performance of the MSCI Europe Index is the performance of the individual companies that are represented in the index. If large companies like Nestle or SAP deliver good results, this will have a positive impact on the performance of the index.

- However, the performance of the MSCI Europe Index should not be the only decisive factor when it comes to investment decisions. Investors must also consider other factors such as risk, cost and stability.

- One way to invest in the MSCI Europe Index is to invest in an ETF (exchange-traded fund) that tracks the index. This gives investors broad diversification across many European companies.

Overall, the performance of the MSCI Europe Index is an important indicator of the performance of the European equity market. However, investors should not rely solely on the performance of the index, but should also consider other factors to make an informed investment decision.

Future prospects for the MSCI Europe Index

The MSCI Europe Index is one of the most important benchmark indices for European equities. The index contains stocks of companies from 15 European countries and is therefore an important indicator of the health of the European economy. Despite some recent volatility, the future outlook for the index points to stable growth.

Key factors influencing the future outlook of the MSCI Europe Index include political developments in Europe and globally, economic conditions and corporate results. A strong economic recovery in Europe and rising stock prices could continue to drive the index in the coming years.

Another factor that could influence the future outlook of the MSCI Europe Index is the rise of ESG (environmental, social and governance) investing. Many investors are placing increasing emphasis on the social and environmental responsibility of companies in which they invest, and on good governance practices. Companies that meet these requirements could therefore receive a higher weighting in the MSCI Europe Index in the future.

- Overall, the MSCI Europe Index is an important indicator of the health of the European economy and offers investors the opportunity to invest in a broad range of European stocks.

- The future outlook for the index is positive, as a strong economic recovery and increasing ESG investments could further drive the index.

- However, it is important to note that in an ever-changing market, there can always be uncertainties that affect the performance of the index.

Overall, the MSCI Europe Index holds good growth opportunities for investors who wish to invest in European equities. It should be noted, however, that all investments involve risk and that a thorough analysis of market trends and the investment portfolio is important to develop a successful investment strategy.